Welcome to the ERM Blog! Browse the posts below for insights into risk management theory and practice from Ireland and internationally. Or search our extensive ERM Resource Database for more information on a particular risk category.

For the latest blog updates, please Follow our LinkedIn ERM page.

The ERM Blog and ERM Resource Database are maintained by the SAI’s Enterprise Risk Management Committee. If you have any feedback or you are interested in information about contributing to the blog, please contact the Society.

Where this information includes links to other sites and resources provided by third parties, these links are provided for general information only. The Society assumes no responsibility for the contents of such third party offerings.

Recap of Risk Management Perspectives Conference 2024

Darragh McHugh

Date Published: August 2024

On the 25th June, the Risk Management Perspectives conference was held in the Round Room at the Mansion House in Dublin. The agenda for the day covered a broad range of risk related topics including Climate, DORA and AI. The event attracted over 130 attendees, including both SAI members and non-members with an interest in risk management.

Enterprise Risk Management in Pensions

Emmet McCabe

Date Published: June 2024

The value of this ERM-style approach will have its supporters and its critics (any actuaries now practising as a risk KFH will have experienced this first hand over the last few years). The pensions industry has been slower to adopt ERM practices than the wider corporate world where the path is more well-trodden with CROs and large risk departments in place in many companies and the benefits of embedding ERM may not be immediately apparent.

Would an Actuary have prevented SVB’s Failure?

John McCrossan

Date Published: March 2023

The initial idea of this blog was to compare risk management practices, but I have decided to use the SVB crisis and take a “what if scenario” approach to illustrate how an Actuary may have helped SVB.

Climate Change in the ORSA

Robert Fitzgerald

Date Published: June 2022

This blog is intended to be of most use to members who have not yet included any climate scenarios in their ORSA. However, it should be readily accessible to all risk professionals and may provoke some further thoughts for those further along with their ORSA considerations.

High Level Risk Considerations Relating to the Russian Invasion of Ukraine

ERM Committee

Date Published: April 2022

The Society of Actuaries in Ireland (“Society”) is a member association of the Actuarial Association of Europe (“AAE”). The Society supports the statement of solidarity issued by the AAE in relation to the Russian invasion of Ukraine.

While we hope that this invasion is resolved in as peaceful a way as possible, we have to plan for the worst. Many companies will have set up committees to monitor the progress of the crisis and the potential impact it will have on their business in the short and long term.

IFoA Thought Leadership Speaker Series

Miriam Sweeney

Date Published: November 2021

In 2021 the UK Institute and Faculty of Actuaries (‘IFOA’) introduced a thought leadership speaker series. The aim of this series is to “help promote innovate thinking, debate and discussion both within and beyond the actuarial profession”. The series covers a wide range of very important topics including sustainability and climate change, the future of the actuarial profession, finance in the public interest, actuarial innovation in the Covid-19 era and behavioural science.

Annual Convention 2020 ERM Presentation

Patrick Meghen

Date Published: May 2021

At the Society of Actuaries Annual Conference in December 2020, as part of the ‘on-demand’ sessions, Clive Kelly ran a session on “Compliance and Risk – a match made in heaven?”, which outlined why compliance should be about more than just regulatory requirements.

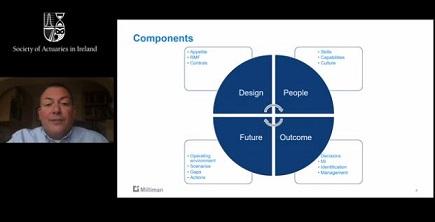

Measuring the Effectiveness of Risk Management Frameworks

Francis Coll

Date Published: March 2021

At the Society of Actuaries Annual Conference in December 2020, as part of the ‘on-demand’ sessions, Neil Cantle of Milliman outlined a concise and practical approach to reviewing the effectiveness of risk management frameworks.

COVID-19

ERM Committee

Date Published: April 2020

The ERM Committee has compiled the below checklist for companies outlining some considerations in light of the Covid-19 pandemic. This is not an exhaustive list and there may be additional items not included on the list which are material to individual companies.

The Development of a European Actuaries Climate Index

Philip Shier

Date Published: March 2020

The first Actuaries Climate Index (ACI) was developed in North America, sponsored jointly by the American Academy of Actuaries, the Casualty Actuarial Society, the Canadian Institute of Actuaries, and the Society of Actuaries. This went live in November 2016. In 2018, the Actuaries Institute Australia released the first results of its climate index (AACI).

Risk Coalition – Paper on principles based guidance for board risk committees and risk functions

Miriam Sweeney

Date Published: February 2020

The Risk Coalition is an association of not-for-profit professional bodies and membership organisations committed to raising the standards of risk management in the UK. In December 2019, following industry consultation, it published “Raising the bar: Principles-based guidance for board risk committees and risk functions in the UK Financial Services sector”. A key aim of this guidance is to provide a benchmark against which board risk committees and risk functions can be assessed objectively. Although written for UK firms, it is equally useful for financial services companies regulated in Ireland.

Stress and Scenario Testing – What is it?

Dave O’Shea

Date Published: November 2019

In its simplest form, Stress and Scenario testing (referred to as “SST” in this article) encourages business leaders to think about what might happen, either now or at some stage in the future, so as to assess how it might impact their business. By considering SST in a structured way, it can generate ideas on how to grow the business, or how to position it so as to avoid potential losses (or maximise certain gains). It can help you identify new opportunities, or areas where current business models are threatened.

Climate Change Risk – Emerging Themes from Regulators

Svilena Dimitrova

Date Published: July 2019

Many regulatory bodies and organisations have expressed their concerns about climate change risk and have recently published papers and opinions on the issue. There is increasing demand from investors for meaningful and decision-useful environmental disclosures. This blog post summarises the key implications, recommendations, challenges and next steps that have been highlighted by regulators.

Data science, actuaries and codes of conduct: Actuarial bodies highlight the importance of codes of conduct in data science activity

Eamonn Phelan

Date Published: June 2019

This blog summarises some of the recent communications from a number of bodies, including the AAE and the AAA, in the area of data science. In particular, this blog focuses on the actuaries’ code of conduct, and what the professional responsibilities of actuaries means when applying the tools and techniques used in data science.

The IAIS consultation paper on their proposals for a “Holistic Framework for Systemic Risk in the Insurance Sector

Miriam Sweeney

Date Published: May 2019

On 14th November 2018 the International Association of Insurance Supervisors (‘the IAIS’) published a consultation paper on their proposals for a “Holistic Framework for Systemic Risk in the Insurance Sector”. The consultation closed in January 2019.

The following blog summarises some of the key points from the consultation paper, and from the responses to the paper which were submitted by Insurance Europe and the IAA.

EIOPA proposes changes to Solvency II and the IDD on climate change and sustainability for life and non-life insurers

Bridget MacDonnell

Date published: February 2019

EIOPA’s consultation on the integration of sustainability risks into both Solvency II and the Insurance Distribution Directive (IDD) closed to responses on 30th January. Under the proposed changes to the Solvency II Delegated Regulation, the risk management function will explicitly be required to have a role in identifying and assessing sustainability risks; the actuarial function opinion on the underwriting policy will need to address sustainability risks; and sustainability risks will be integrated into the requirements governing investments under the Prudent Person Principle. Such changes could lead to a number of challenges and opportunities for both life and non-life insurers – these are discussed further in the blog post here.

EIOPA Consultation on National Insurance Guarantee Schemes

Bridget MacDonnell & Eamonn Phelan

Date published: October 2018

In July 2018, the European Insurance and Occupational Pensions Authority (EIOPA) issued a discussion paper on resolution funding and national Insurance Guarantee Schemes (IGSs) across the EU. This proposes a harmonised approach to national IGSs where the landscape is currently highly fragmented. (Re)insurance companies should be aware of the potential costs and benefits which could accompany any future harmonised approach.

The following blog summarises the key elements and potential impacts of this discussion paper. It also references EIOPA’s continued work on systemic risk and macroprudential policy in insurance. Click here to read more.

Review of the SCR Standard Formula

Patrick Meghen

Date published: May 2018

EIOPA have recently submitted two sets of advice to the European Commission regarding proposed revisions to certain aspects of the Standard Formula. This paper aims to outline, at a high level, the approach being taken and the areas which could be subject to change should EIOPA’s recommendations be approved. Click here to read more.

Internal Model Industry Forum: The Journey from Model Validation to Model Risk Management

Eamonn Mernagh

Date published: April 2018

In February 2018, the Internal Model Industry Forum of the Institute of Risk Management published a paper on “The Journey from Model Validation to Model Risk Management”. The paper provides some useful insights for all companies, not just those using Internal Models, on how model risk can be appropriately managed. Click here to read more.

Recovery and Resolution Plans: More to it than meets the eye

Bridget MacDonnell

Date published: April 2018

Have you ever wondered what options would be available to your company should it get into financial difficulty? Does your company have a ‘plan B’ and how practical and realistic is it? This blog outlines a few insights that the insurance industry can learn from the recovery and resolution planning process which is at a more advanced stage in the banking industry. Click here to read more.

Recent developments in conduct risk management

Recent developments in conduct risk management

Eamonn Phelan

Date published: April 2018

Conduct risk is receiving increased focus from legislators, regulators and global industry bodies, something which is reflected in the significant volume of recent and soon to be implemented initiatives. This article provides an overview of some recent global developments relating to conduct risk, which may be noteworthy for those keeping an eye on activity in this space. Click here to read more.

Risk Management Perspectives Conference

Bridget MacDonnell

Date published: January 2018

The Society of Actuaries in Ireland (SAI) Risk Management Perspectives Conference took place on 25th October at the Intercontinental Hotel, Ballsbridge, featuring a variety of speakers and thought-provoking sessions. This article provides a brief overview of the items discussed. Click here to read more.

12 Page ORSA (SAI ERM Forum)

Danielle O'Sullivan

Date published: September 2017

The Own Risk & Solvency Assessment (ORSA) is viewed by many as one of the most beneficial aspects of the Solvency II regime – particularly for the Board – bringing together the outputs from several risk and capital processes to provide an overall picture of the insurer’s solvency and key risks. But how good are we, as risk professionals, at distilling all this information into one user friendly document and is the ORSA report, in its current guise, really fit for purpose? Click here to read more

Brexit (SAI ERM Forum)

Daneille O'Sullivan

Date published: September 2017

It’s fair to say that Brexit has been the buzzword in the industry for over a year but now that the votes are in and Article 50 has been triggered are we really any wiser as to what this could mean for our companies, for us as a profession or indeed for us as individuals? Click here to read more.

ETVs – always reducing risk?

Bryan O'Higgins

Date published: July 2017

Enhanced Transfer Value (ETV) exercises are usually run by sponsoring employers in order to reduce risk. However without appropriate governance, the exact opposite might occur. Click here to read more.

Actuarial Aspects of ERM for Insurance Companies

Date published: January 2016

The purpose of this paper is to provide assistance to actuaries or other practitioners in relation to Enterprise Risk Management (“ERM”) and to help to achieve greater consistency in relation to knowledge and awareness of various topics. Click here to read more.

Liquidity risk: A wolf in sheep’s clothing?

Eamonn Phelan

Date published: 16th January 2017

Identification and effective management of the primary sources of liquidity risk can make the difference between survival and failure of the business. It’s something that we can’t afford to leave to chance. Click here to read more.

Interest Risk in a Solvency II Environment

Eamonn Mernagh

Date published: 6th December 2016

The introduction of Solvency II has brought with it an increase in interest rate sensitivity for insurers with long tailed liabilities. This post discusses the drivers of this volatility and some potential solutions that are available. Click here to read more.

Spotlight on Operational and Reputational Risk

Bridget MacDonnell

Date published: 6th December 2016

Operational and reputational risks have become areas of greater focus in recent times. In this blog post, we take a closer look at current perspectives and the techniques available for managing these risks. Click here to read more.

Risks to the profession and public interest arising from actuarial activity

Billy Galavan

Date published: 20th October 2016

As part of its action plan for 2016, the Enterprise Risk Management (ERM) Committee of the Society of Actuaries of Ireland was asked to assist in assessing the sources of risk to the profession / public interest arising from activities carried out by members of the profession. The request arose from a discussion on risks to the public interest between Dervla Tomlin, President of the Society, and Tom Donlon, Chair of the ERM Committee. The ERM Committee’s remit already included a priority action to help drive an enhanced reputation for the Society and build trust in actuarial services. It was decided that the ‘Risk’ group within the ERM Committee would drive the response to this request. Read more.

Risk Management forum – Gardaí advise actuaries on Cyber Fraud

Eric Brown

Date published: 29th July 2016

There are a number of emerging risks in the insurance industry. The forum provided an opportunity to bring people together to discuss two of these – consumer risk and cyber risk – and also consider a high level overview of current hot topics. Read more

Assessing risk management – how to avoid an own goal

Alex Breeze

Date published: 30th May 2016

Picture the scene: Having battled to a goalless draw against Sweden and succumbed to defeat against a clinical Belgian side (and a highly debateable refereeing decision), the Republic of Ireland soccer team go into their final Euro 2016 group game with Italy knowing that only a win will guarantee progression in the competition, but a draw might be enough if other results go their way... Read more

Aspiro – the European Court of Justice adds further pressure to insurance premiums

Tom Donlon

Date published: 24th May 2016

The Question

The Warsaw based company “Aspiro” has been supplying claims handling services to insurance companies in Poland for many years. Aspiro performs a wide range of services for insurance companies covering most of the day to day activities that are necessary in a modern claims function...Read more