Risk Equalisation and Regulation in Private Health Insurance

The Irish Private Health Insurance market is one of the largest voluntary health insurance markets in the world with close to €2.5 billion of premiums being paid in 2017 and over 45% of the population being covered by the existing players in the market. One of the key principles underpinning the market has been the need to ensure that regardless of your risk profile you have the opportunity to be purchase affordable insurance such that all customers pay the same for the same level of cover.

This concept of risk solidarity has been supported for many years by a number of important regulatory mechanisms. One of the key elements is ‘community rating’ under which insurers are obligated to charge all consumers the same level of premium for the same level of benefits regardless of their age or heath status. Furthermore, risk equalisation has been used as an important support to the market to provide stability across the market and, at present, it is projected that over €730m of premiums are part of the risk equalisation mechanism facilitated by the Health Insurance Authority and the Revenue Commissioners.

For many years, there has been some debate as to what are the required regulatory reforms to sustain the market and ensure that costs are shared fairly across the market. This seminar provides a unique opportunity to discuss: future outlook for the market; existing challenges in relation to the regulation of the market; and consider future proposals (including implementation aspects) in regard to risk equalisation in Ireland. The discussion will be based upon evidence from the experiences of many of the countries who have similar regulated models of health insurance.

We have invited leading global experts in the field who have extensive experience in risk equalisation to share the experiences with the audience.

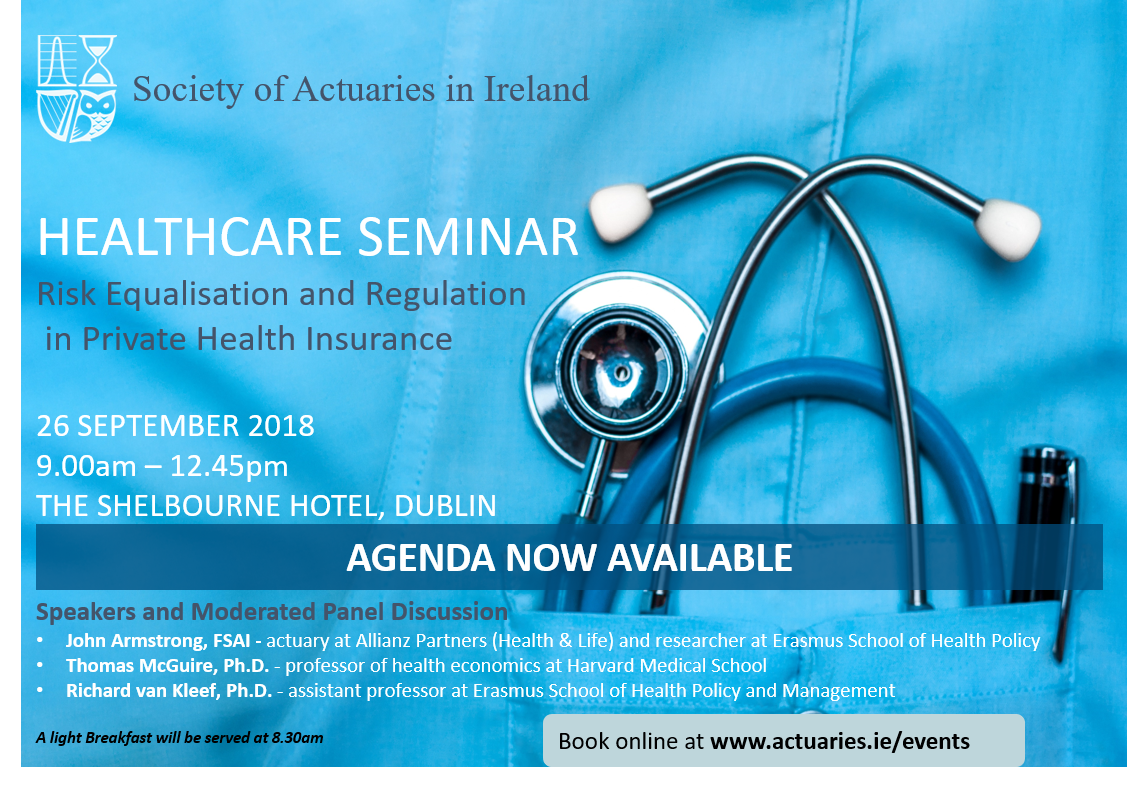

The agenda is now available below.

To access podcasts please contact the Society: info@actuaries.ie

The agenda is now available below