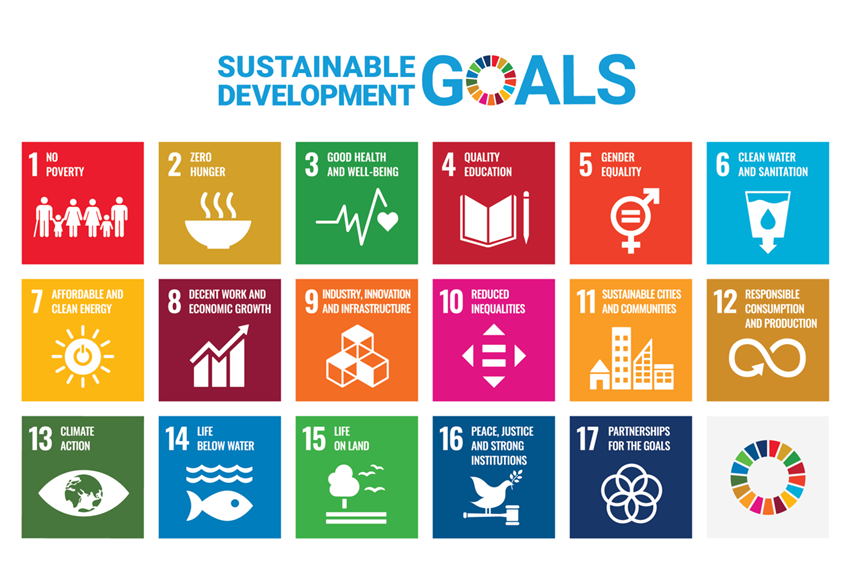

The current Climate and Nature crises demonstrate that continuing with business-as-usual is not an option. The United Nations (‘UN’) 2015 resolution, "Transforming our World: the 2030 Agenda for Sustainable Development" provides a vision “to shift the world onto a sustainable and resilient path”. It includes 17 Sustainable Development Goals (‘SDGs’) (Figure 1) and associated 169 targets, to be achieved by 2030. They cover the interconnected environmental (e.g., climate action), social (e.g., gender equality), and economic (e.g., decent work) aspects of sustainable development. All sectors of society, including the corporate sector, are asked to re-orient themselves toward achieving these goals.

The purpose of this blog is to provide insights from a review of the academic literature on corporate impact on the UN SDGs. This is instructive both for companies already engaged with the SDGs, whether explicitly or implicitly, and for those wishing to engage but not sure where to start. This literature review was carried out as part of a recent research project contributing to an MSc. in Management for Sustainable Development with Dublin City University.

Figure 1 The UN Sustainable Development Goals

Source: Communications materials - United Nations Sustainable Development

Unfortunately, the UN’s 2023 Global Sustainable Development Report highlights that the majority of the SDG targets are off-track, with many of them showing a worsening trend between 2020 and 2023, driven by the COVID-19 pandemic, ongoing conflicts, and high global inflation. On the 18th of September 2023, world leaders attending the UN’s SDG Summit supported a Political Declaration confirming their commitment to achieving the SDGs, including through reform of the international financial architecture.

Achieving the SDGs will require systemic transformation. Scenario analysis carried out for the 2023 Global Sustainable Development Report concludes that under current political and economic conditions, the SDGs will not be achieved by 2050, never mind 2030. However, ambitious sustainable development scenarios are possible which could achieve many of the SDGs. The provision of finance is a critical lever in delivering sustainable development. The UN estimates the gap in additional annual investment required to achieve the SDGs globally as up to $4.2 trillion, which sounds large but is only 1.1% of the estimated $379 trillion of global assets under management (including bank deposits). A recurring theme in the academic literature is the need for businesses, including financial services institutions, to embrace the transformational ethos of the SDGs. Speaking at Climate Finance Week Ireland 2023, Mark Halle, Senior Fellow at the International Institute for Sustainable Development, argued that the financial system needs to be transformed so that all finance is sustainable, which in his view means that all financial transactions deliver “net-zero, nature-positive, equitable outcomes”.

However, the SDG framework is voluntary, and transformation is difficult1. This leads to the question of why businesses, including financial organisations, should undertake such an effort.2 Much of the literature frames the answer to this question in terms of a business case, in line with the dominant economic viewpoint that the overriding purpose of a business is to make profits. There are valid arguments to engage with the SDGs for new business opportunities, competitive advantages, reputational benefits, and additional/preferential sources of financing.3

Unfortunately, these arguments can only go so far. Many researchers doubt that the business case perspective is sufficient for achieving the necessary systemic change, as SDG engagement does not always align with commercial interests.4 There may be tensions between economic, social, and environmental objectives, and between short-term and longer-term goals.5 As a result, there is an evolving discussion on the fundamental purpose of business.6 New business models are emerging such as social enterprises, which prioritise social and/or environmental objectives over short-term profit-maximisation.7 Additionally, more companies are acknowledging the tensions involved in contributing to the SDGs and developing strategies to cope with these, such as including both short-term and long-term goals in performance incentives.8 Government policy, including regulation, is also considered a key driver of change in corporate behaviour.9

Companies already engaging or planning to engage with the SDG framework need to consider their motivation and not engage with the SDGs lightly. Otherwise, there is a risk of “SDG-Washing”, where SDG engagement is superficial rather than leading to substantive change.10 In this context, criticised practices include “cherry-picking” the SDGs that are easiest to deal with, ignoring the negative impacts of core activities, avoiding additional effort by repackaging current activities in an SDG context, and influencing the SDG agenda solely for commercial advantage.11 These practices leave companies exposed to reputational damage, especially in the medium to longer term.12 A related argument is that a company’s core activities need to benefit society for its brand to have long-term value.13

The main advantage of using the SDG framework is its international recognition, providing a common language for the discussion of sustainability issues.14 On the other hand, the framework is complex, with multiple associated practical challenges, including data gaps and performance measurement challenges, which contribute to the problem of superficial engagement.15 The UN SDG Impact Standards for Enterprises support companies in substantively contributing to the SDGs by integrating them into strategy, management, transparency, and governance. These standards recognise the challenge of assessing corporate impact and provide high-level principles to follow, including the necessity of target-setting and monitoring against appropriate baselines. They do not provide detailed performance indicators or benchmarks.

In general, there is no single SDG performance measurement framework for businesses.16 There are multiple tools available for supporting companies in assessing their impact on the UN SDGs, but they vary considerably in scope, and each company needs to choose those that best suit its unique situation.17 The UN has developed a set of 232 Global SDG Indicators for country-level monitoring, of which c. 20% can be directly applied by businesses as a starting point.18 Examples of indicators relevant to businesses include the proportion of women in managerial positions (SDG 5), the share of renewable energy in total energy consumption (SDG 7), the number of fatal and non-fatal work-related injuries (SDG 8), metrics on research and development expenditure (SDG 9), metrics on waste generation and re-use/recycling (SDG 12), and total greenhouse gas emissions (SDG 13). However, as most of the UN indicators can’t be easily applied by businesses, the SDG Compass maps commonly used business indicators to the SDG targets. Similarly, the Global Reporting Initiative provides various practical tools, including a mapping of its standards to the SDG targets. For companies subject to the EU Corporate Sustainability Reporting Directive, an Explanatory Note, published at the draft reporting standard stage, explains how the UN SDGs are reflected. These are just some examples of available guidance/tools, there are many more. A participatory process of developing suitable indicators for the purposes of impact assessment can facilitate acceptance and learning about sustainability issues throughout an organisation.19

From an actuarial perspective, an excellent 2020 IFOA podcast series considers the role of actuaries in contributing to the SDGs, covering amongst other topics the impact of biodiversity on the insurance and finance industries (SDG 14 Life Below Water and SDG 15 Life on Land), what the insurance industry is doing to better support people with mental health challenges (SDG 3 Good Health and Wellbeing), and impact investing for pension funds (which can support multiple SDGs). This podcast series demonstrates that actuaries are well placed to reflect on the considerations raised in this blog and contribute to the transformation required for a sustainable world.

References

- de los Reyes, G. and Scholz, M. (2019) ‘The limits of the business case for sustainability: Don’t count on “Creating Shared Value” to extinguish corporate destruction’, Journal of Cleaner Production, 221, pp. 785–794. Available at: https://doi.org/10.1016/j.jclepro.2019.02.187.

- Celone, A., Cammarano, A., Caputo, M. and Michelino, F. (2021) ‘Is it possible to improve the international business action towards the sustainable development goals?’, critical perspectives on international business, 18(4), pp. 488–517. Available at: https://doi.org/10.1108/cpoib-08-2020-0122.

- For example, see Song, L., Zhan, X., Zhang, H., Xu, M., Liu, J. and Zheng, C. (2022) ‘How much is global business sectors contributing to sustainable development goals?’, Sustainable Horizons, 1, p. 100012. Available at: https://doi.org/10.1016/j.horiz.2022.100012.

- As per note 2.

- van Bommel, K. (2018) ‘Managing tensions in sustainable business models: Exploring instrumental and integrative strategies’, Journal of cleaner production, 196, pp. 829–841. Available at: https://doi.org/10.1016/j.jclepro.2018.06.063.

- Jimenez, D., Franco, I.B. and Smith, T. (2021) ‘A Review of Corporate Purpose: An Approach to Actioning the Sustainable Development Goals (SDGs)’, Sustainability (Basel, Switzerland), 13(7), p. 3899. Available at: https://doi.org/10.3390/su13073899.

- Department of Rural and Community Development (2023) ‘Social Enterprises in Ireland, A Baseline Data Collection Exercise’. Government of Ireland. Available at: https://www.gov.ie/pdf/?file=https://assets.gov.ie/258465/1cb50b94-6a17-450e-bca7-dea5ff6d2864.pdf#page=null.

- As per note 5.

- Nishitani, K., Nguyen, T.B.H., Trinh, T.Q., Wu, Q. and Kokubu, K. (2021) ‘Are corporate environmental activities to meet sustainable development goals (SDGs) simply greenwashing? An empirical study of environmental management control systems in Vietnamese companies from the stakeholder management perspective’, Journal of Environmental Management, 296, p. 113364. Available at: https://doi.org/10.1016/j.jenvman.2021.113364.

- Heras‐Saizarbitoria, I., Urbieta, L. and Boiral, O. (2022) ‘Organizations’ engagement with sustainable development goals: From cherry‐picking to SDG‐washing?’, Corporate social-responsibility and environmental management, 29(2), pp. 316–328. Available at: https://doi.org/10.1002/csr.2202.

- Gneiting, U. and Mhlanga, R. (2021) ‘The partner myth: analysing the limitations of private sector contributions to the Sustainable Development Goals’, Development in practice, 31(7), pp. 920–926. Available at: https://doi.org/10.1080/09614524.2021.1938512.

- Manes-Rossi, F. and Nicolo’, G. (2022) ‘Exploring sustainable development goals reporting practices: From symbolic to substantive approaches—Evidence from the energy sector’, Corporate Social Responsibility and Environmental Management, 29(5), pp. 1799–1815. Available at: https://doi.org/10.1002/csr.2328.

- Rekom, J., Berens, G. and Halderen, M. (2013) ‘Corporate social responsibility: Playing to win, or playing not to lose? Doing good by increasing the social benefits of a company’s core activities’, The journal of brand management, 20(9), pp. 800–814. Available at: https://doi.org/10.1057/bm.2013.13.

- Jun, H. and Kim, M. (2021) ‘From Stakeholder Communication to Engagement for the Sustainable Development Goals (SDGs): A Case Study of LG Electronics’, Sustainability (Basel, Switzerland), 13(15), p. 8624. Available at: https://doi.org/10.3390/su13158624.

- van Zanten, J.A. and van Tulder, R. (2021b) ‘Improving companies’ impacts on sustainable development: A nexus approach to the SDGS’, Business strategy and the environment, 30(8), pp. 3703–3720. Available at: https://doi.org/10.1002/bse.2835.

- Florêncio, M., Oliveira, L. and Oliveira, H.C. (2023) ‘Management Control Systems and the Integration of the Sustainable Development Goals into Business Models’, Sustainability, 15(3), p. 2246. Available at: https://doi.org/10.3390/su15032246.

- Schönherr, N., Reisch, L.A., Farsang, A., Temmes, A., Tharani, A. and Martinuzzi, A. (2019) ‘The Corporate Toolbox’, in N. Schönherr and A. Martinuzzi (eds) Business and the Sustainable Development Goals: Measuring and Managing Corporate Impacts. Cham: Springer International Publishing. Available at: https://doi.org/10.1007/978-3-030-16810-0.

- Calabrese, A., Costa, R., Gastaldi, M., Levialdi Ghiron, N. and Villazon Montalvan, R.A. (2021) ‘Implications for Sustainable Development Goals: A framework to assess company disclosure in sustainability reporting’, Journal of Cleaner Production, 319, p. 128624. Available at: https://doi.org/10.1016/j.jclepro.2021.128624.

- Roos Lindgreen, E., Opferkuch, K., Walker, A.M., Salomone, R., Reyes, T., Raggi, A., Simboli, A., Vermeulen, W.J.V., Caeiro, S., and Environmental Governance (2022) ‘Exploring assessment practices of companies actively engaged with circular economy’, Business strategy and the environment, 31(4), p. 1414 Available at: https//doi/full/10.1002/bse.2962.

Miriam Sweeney

Miriam Sweeney is an experienced actuary specialising in risk management. She currently chairs the SAI's ERM Committee. She recently completed an MSc. in Management for Sustainable Development with Dublin City University

Published December 2023

The views of this article do not necessarily reflect the views of the Society of Actuaries in Ireland, the Sustainability and Climate Change Steering Group, or the author’s employer.